Beyond Passwords and One-Time Passcodes: Secure Authentication with an Additional Factor

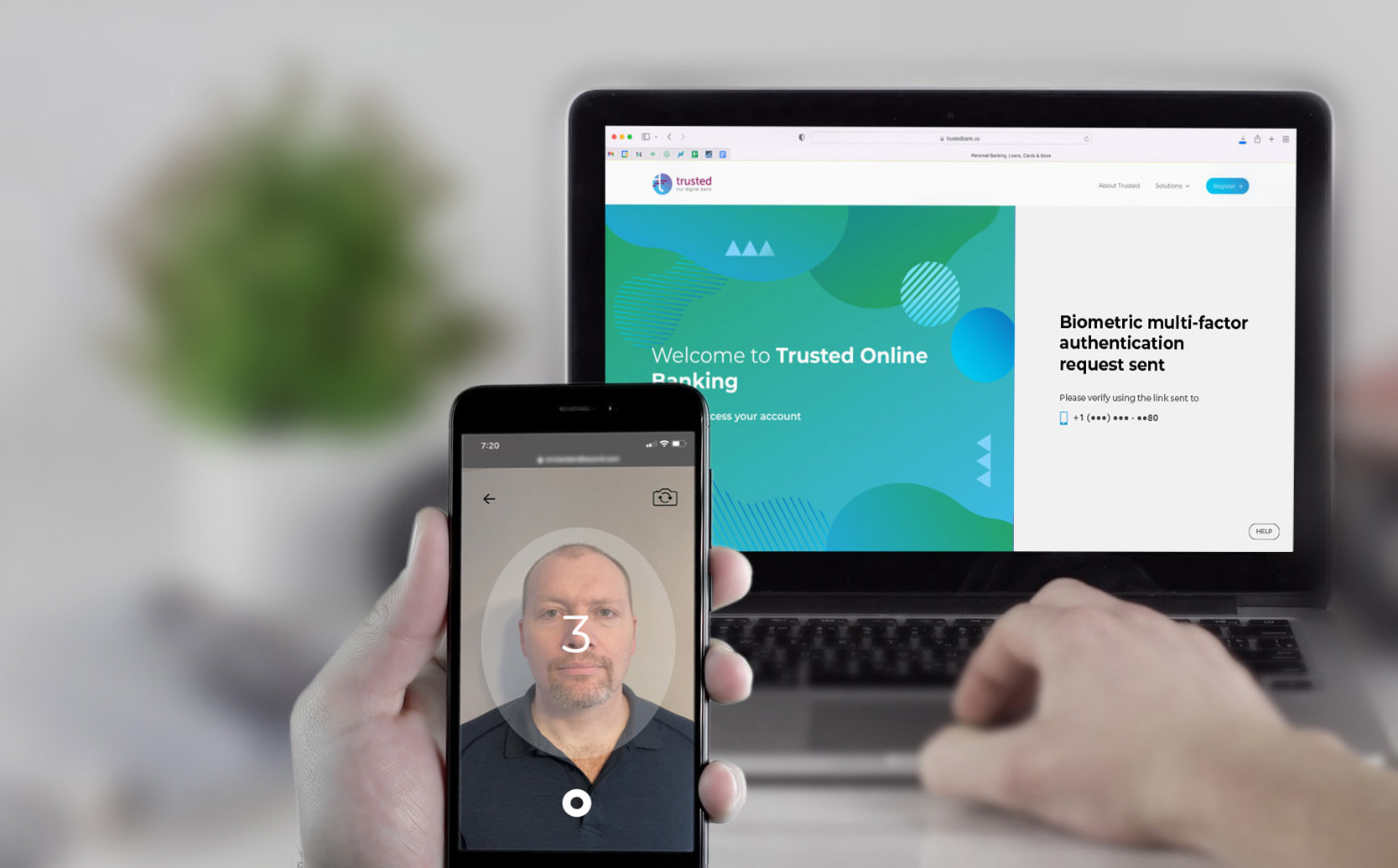

Trust Stamp's Biometric Multi-Factor Authentication (BMFA) integrates seamlessly with financial institutions' existing systems, adding a layer of security that verifies customers' identities using their unique biometric data. From facial recognition to voice analysis, our sophisticated BMFA solutions ensure that only the true account holder can access their account or facilitate transactions.